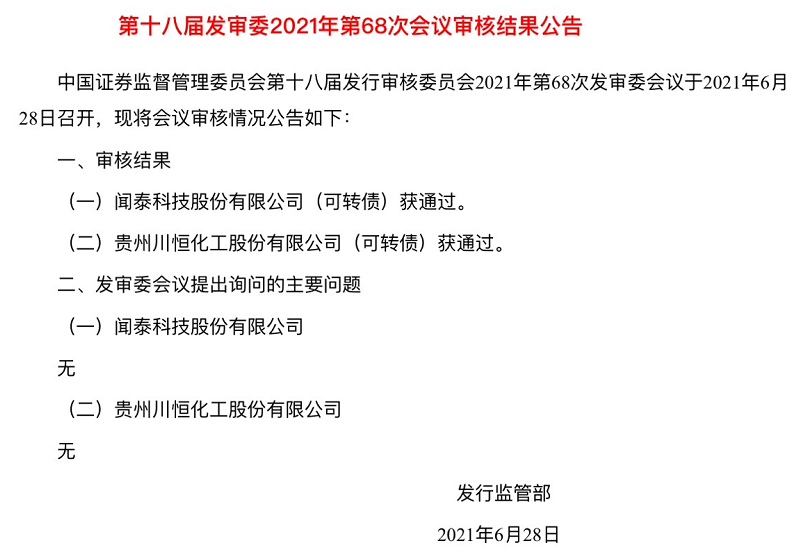

Wingtech Technology 8.6 billion CNY Convertible Bond Approved, Accelerating Its Strategic Transformation

On June 28, China Securities Regulatory Commission (CSRC) announced that the public issuance of convertible bonds by Wingtech Technology Co., Ltd. (600745.SH) was approved by the CSRC.

According to the announcement, Wingtech Technology raised no more than 8.6 billion CNY in the public offering of convertible corporate bonds. The raised funds will be used for Wingtech Wuxi Intelligent Manufacturing Industrial Park Project, Wingtech Kunming Intelligent Manufacturing Industrial Park Project (Phase II), Wingtech India Intelligent Manufacturing Industrial Park Project, the construction project of mobile intelligent terminals and accessories R&D Center, as well as the supplement of working capital and repayment of bank loans.

No | Project | Investment | Use of raised funds |

1 | Wingtech Wuxi Intelligent Manufacturing Park | 44.67 | 32.00 |

2 | Wingtech Kunming Intelligent Manufacturing Park (Phase II) | 30.95 | 22.00 |

3 | Wingtech India Intelligent Manufacturing Park | 15.75 | 11.00 |

4 | Intelligent Mobile terminal and accessories research and development center | 3.52 | 3.00 |

5 | Replenish working capital and repay bank loans | 18.00 | 18.00 |

Subtotal | 112.89 | 86.00 | |

On June 23, Wingtech Technology disclosed in the announcement in reply to the Shanghai Stock Exchange that the fixed assets of the mobile terminal sector accounted for 2.01% of the revenue, much lower than the average 51.88% in the industry. The main reason is that the fixed assets of Wingtech Technology are mainly machinery and equipment, and the amount of factory buildings is small. It shows that its asset-light operation mode is different from other companies in the industry, such as Luxshare Precision, Foxconn Industrial Internet, Goertek and Lens Technology. The approval of 8.6 billion CNY convertible bond project is expected to greatly enhance the production capacity and scale of Wingtech’s mobile terminal sector and semiconductor assembly and test.

Fixed assets/ Income | Wingtech Technology | Industry Average | Luxshare | Foxconn | Goertek | Lens Technology |

Mobile terminals | 2.01% | 51.88% | 26.97% | 5.36% | 37.29% | 137.91% |

Fixed assets/ Income | Wingtech Technology | Industry Average | Yangjie | Silan | Goodark | Jie Jie |

Semiconductor | 66.56% | 94.83% | 61.38% | 120.81% | 87.07% | 110.06% |

As a global leading company in the semiconductor and communications industry, Wingtech Technology will increase its R&D investment and collaborative innovation in the semiconductor business and communication product integration business in 2020. Although affected by the global epidemic, it has made great progress in new customer development, new product development, industrial layout and other aspects, and achieved rapid growth in sales volume and net profit.

In semiconductor business, Wingtech Technology has maintained rapid growth, and its revenue and profitability have recovered to or even exceeded the quarterly record levels of the past two years. With the rapid increase of the penetration rate of electric vehicles, the single-vehicle power semiconductor is expected to show a great extent of improvement, bringing huge growth to the industry. Wingtech Technology's automotive qualified power semiconductor business is expected to enter the high growth stage in the medium and long term. Revenue from mobile and wearable devices, industrial and power applications is expected to be a new growth engine, as businesses such as semiconductor and communications product integration grow in synergy.

In the field of communication product integration, Wingtech Technology has invested 2.15 billion CNY to lay a foundation for the future. The R&D centers in Shanghai, Xi 'an, Wuxi, Jiaxing and Shenzhen are continuously recruiting and introducing excellent talents, which has greatly alleviated the company's R&D pressure in the fields of tablet, laptop, IoT, server and automotive electronics. The construction of a 5G intelligent manufacturing industrial park in Kunming, Yunnan province, is coming to the final stage, while factories in Jiaxing and Wuxi are also expanding their production capacity to meet the needs of global customers.

In addition to the steady development of its own business, Wingtech also recently acquired specific customer businesses of O-film, forming the whole industrial chain development pattern of semiconductor IDM, optical module and communication products integration.

Zhang Xuezheng, chairman of Wingtech Technology, said that the strategy of Wingtech is divided into three stages: the first stage, the field of ODM system integration from the consumer field to the industry, IoT field, automotive electronics field product expansion, more products, more customers, greater sales, making ODM business into a powerful hardware traffic platform. In the second stage, Wingtech will accelerate vertical integration. Through merger and acquisition, integration and self-development, Wingtech will integrate and develop more components in the field of semiconductor and components, so as to increase our own supply capacity and form a safe and controllable supply system. In the third stage, Wingtech will take semiconductor as the leader, increase investment, enhance innovation ability, enable components and system integration, comprehensively enhance the core competitiveness of the whole machine products, provide customers with products that no one else has, and establish the moat of the company. Our goal is to promote the strategic transformation of Wingtech from the Professional Solution Company to a Great Product Company.

![关于闻泰[图片]](/static/LM_Img/关于我们_小图-120230320102917.jpg)

![新闻资讯[图片]](/static/LM_Img/新闻资讯2017032011413820171023023641.jpg)

![服务领域[图片]](/static/LM_Img/fuwu2017032011004120171023024342.jpg)

![关于闻泰[图片]](/static/LM_Img/投资者关系20170320110238.jpg)

![人才发展[图片]](/static/LM_Img/人才发展20170320112039.jpg)

![联系我们[图片]](/static/LM_Img/联系我们20170320114037.jpg)